Table of contents

Interest in cryptocurrencies has fluctuated wildly over the last few years.

The market for these digital assets peaked at $2.5 trillion in May 2021. At that time, coins – or specific denominations of currency like DOGE – surged in value by over 7,000%. Then, over the next 12 months, a major coin, LUNA, and trading platform, FTX, both collapsed in spectacular fashion, reducing prices across the market to a fraction of previous highs. Nevertheless, the crypto marketplace has kept some appeal, as trading volume remains high.

If some of that went over your head, you’re not alone. We wanted to know if that confusion is also present in the online presence of crypto companies: for the uninitiated, how easy is it to understand and get started in their online experiences? To find out, we conducted a short benchmark test in the UserZoom platform.

Comparing best-in-class experiences for newcomers

For our test, we chose two of the biggest players in crypto trading: Robinhood and Coinbase. In Robinhood’s first quarterly earnings report after joining the Nasdaq in July 2021, crypto trades accounted for 52% of its overall revenue. And Coinbase was the largest American crypto exchange by trading volume in March 2021.

Since we wanted to understand the beginner experience, we recruited 144 participants with no account on either site. Each participant was assigned to test either the mobile or desktop website on either Robinhood or Coinbase.

Our participants tested ten total tasks:

- Visit the home page and report initial impressions

- Begin the sign up process

- Learn about how to buy crypto

- Learn about account security

- Learn about fees

- Learn about getting a card

- Find recent market updates

- Learn the basics of cryptocurrency

- Contact support

- Learn about the company

Neither experience was stellar for newbies

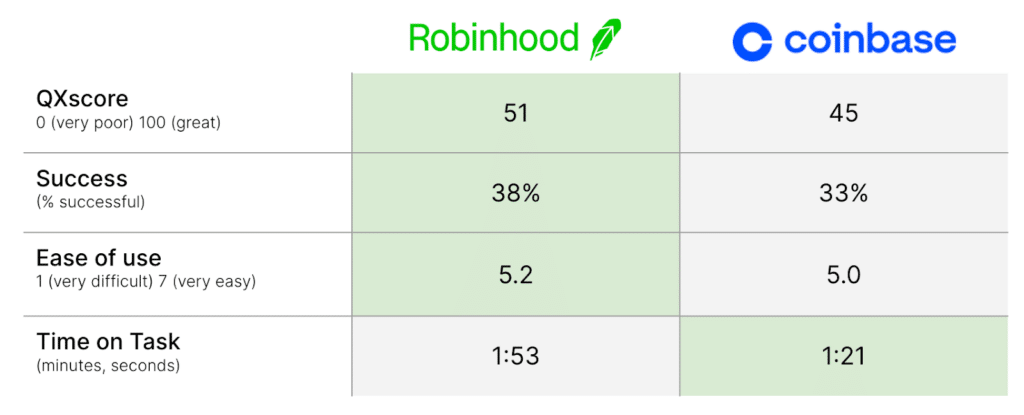

We used the QXscore® to get a broad sense of each site’s user experience. QXscore is a validated usability measure, incorporating both behavioral and attitudinal data, that’s available in the UserZoom platform. Higher scores indicate a better experience on a 101-point scale.

Both sites had scores graded “poor” against our database — with Robinhood coming in slightly higher at 51 versus Coinbase’s 45.

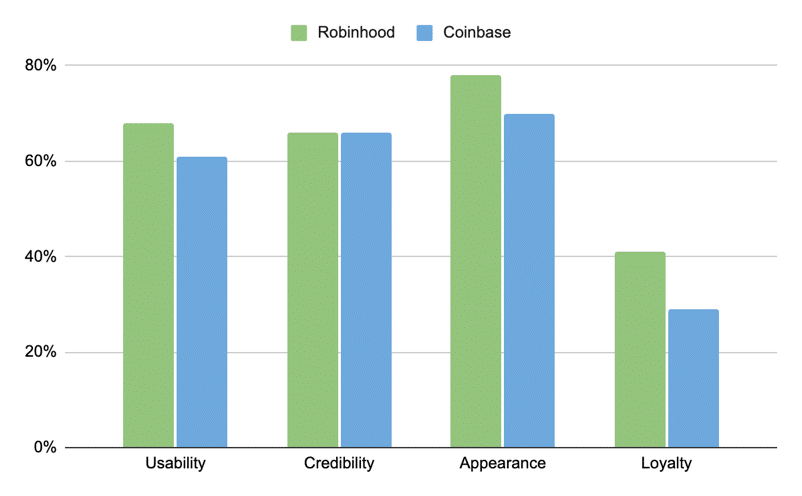

We took a closer look at participants’ overall attitudes towards each site, given at the end of testing. Loyalty, which indicates how likely participants would return to or recommend the site, was low for both — which is fairly common in studies that recruit non-users, like this one.

What else could be driving low scores?

One half of the score’s weight is behavioral — specifically, how successful participants were accomplishing tasks on the site. For each task, the UserZoom platform recorded success when the participant either reached the correct URL, or the participant answered correctly a multiple-choice question that required them to reach the right place.

Task success rates were generally low, with only an average of 38% of participants successfully completing Robinhood tasks and an average of 33% on Coinbase tasks.

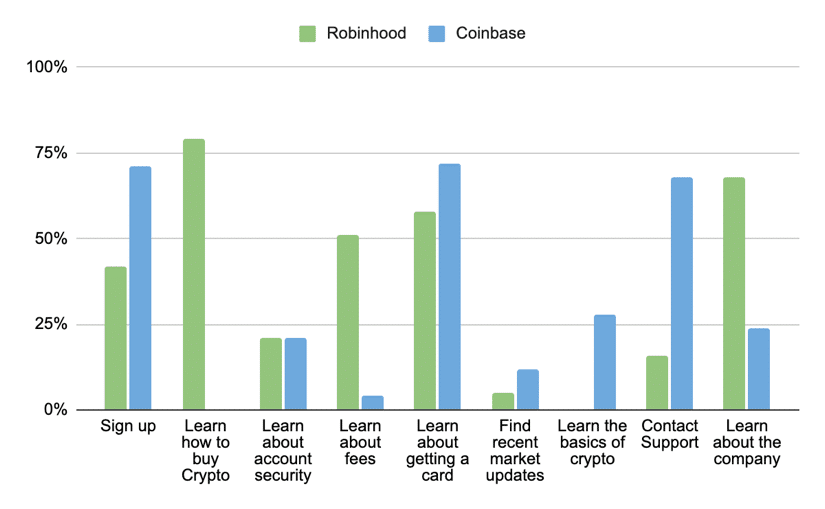

By comparison, a typical success rate for commonly-performed tasks on a mature product or website is 78%. Only one task, learning how to buy crypto on Robinhood (79%), met that benchmark. And several (learning how to buy crypto on Coinbase, and learning the basics of crypto on Robinhood) had no successful participants!

After each task, participants rated how easy or difficult the task was on a 7-point scale, with higher scores indicating an easier task. On Robinhood, participants said finding recent market updates was most difficult (4.4 of 7 on average). Learning about fees was considered most difficult by Coinbase participants (2.9 of 7 on average).

And tasks took a long time to successfully complete.

Robinhood participants took an average of 113 seconds — nearly two minutes — to successfully complete tasks, whereas Coinbase participants took an average of 81 seconds. The longest task for Robinhood, contacting customer support, took five minutes on average. For Coinbase, learning about fees took participants 225 seconds (3.75 minutes) on average to complete.

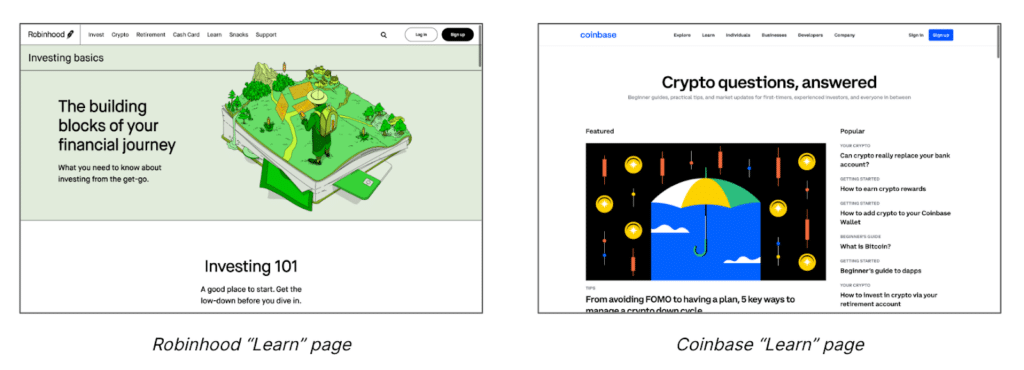

Both platforms have educational sections titled “Learn,” but the content found there wasn’t always relevant or comprehensive.

Participants gravitated toward these sections on many tasks, including some where the content lived elsewhere, like contacting support and learning about the company. For example, Coinbase’s fee structure was tucked away in a support page. Some tasks, such as learning the basics of crypto on Robinhood, had useful content in the “Learn” section, but it wasn’t easily read.

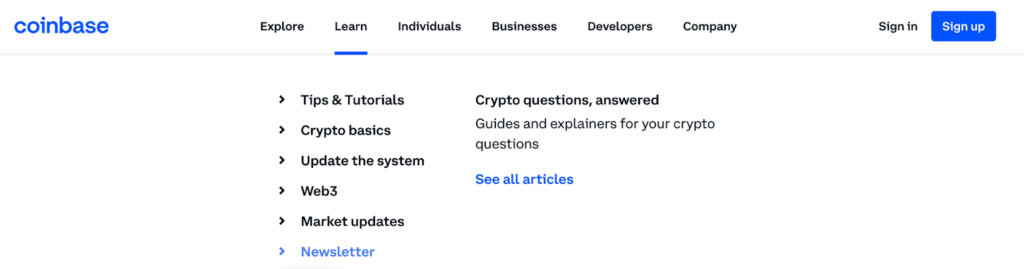

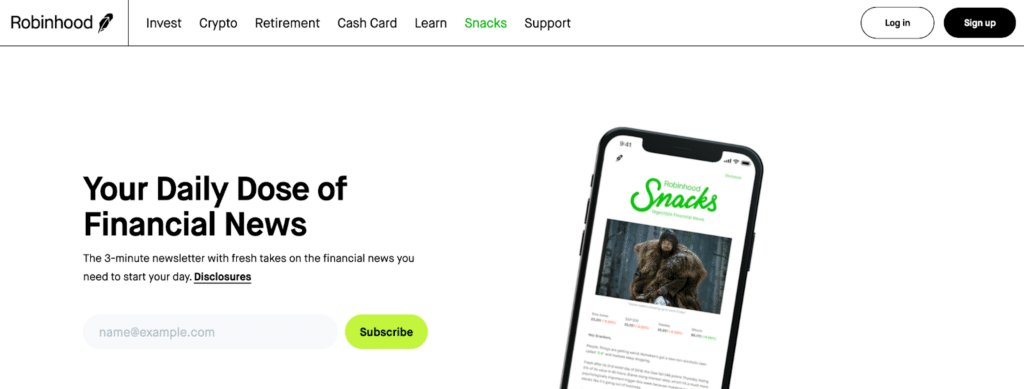

Though Robinhood had a higher QXscore rating and average task success, it had navigation problems. For example, both sites offer an email newsletter with crypto market updates, but Robinhood’s was more difficult to find, as it is listed in the navigation only under the branded name “Snacks,” rather than “Newsletter” (as on Coinbase). In addition, contact information for Robinhood’s customer support could only be found after first choosing and scrolling to the bottom of a support article.

In short, the learning curve is high

Cryptocurrency continues to be a volatile and, to some, attractive asset. But how easy is it to get started? We tested two leaders in bringing the crypto market to non-technical retail traders, Coinbase and Robinhood, and found out:

- Novice participants gave both sites “poor” QXscore ratings, with Robinhood (at 51) just nudging out Coinbase (at 45). Across ten tasks tested on each site, success rates were low (averaging 38% or less) and time to successful completion was long (averaging nearly two minutes).

- These results indicate that, at least for prospects with little understanding of the platform or domain, users need better education and clearer navigation.

- Both sites could improve the experience by providing key information, like access to customer support and fees, in more discoverable locations. Furthermore, both should more clearly delineate support content from educational content, and both should be easily searchable.

It is important to note that although these results were poor for both platforms, they reflect only one dimension of the overall user experience: novice prospects interested in learning about crypto. Both are known for trading platforms that existing users can use effectively and efficiently. Testing these logged-in experiences was beyond the scope of the current benchmark and should be explored further in future studies.

The crypto market has cooled significantly in the last year — that means crypto companies can’t afford to waste any customers, making it even more important that they fix their experiences. The right next step would be to iterate on the experiences and then test again, to validate the benefits of the changes, and identify what else needs to be fixed next.

Thanks to Jamie Skjoldager for her significant contributions at every stage in this research, and to Moriah Galvan for reviewing a draft of this article.

Photo by Art Rachen on Unsplash

The opinions expressed in this publication are those of the authors. They do not necessarily reflect the opinions or views of UserTesting or its affiliates.